An educational approach to help you plan for life events and to make things easier for your loved ones.

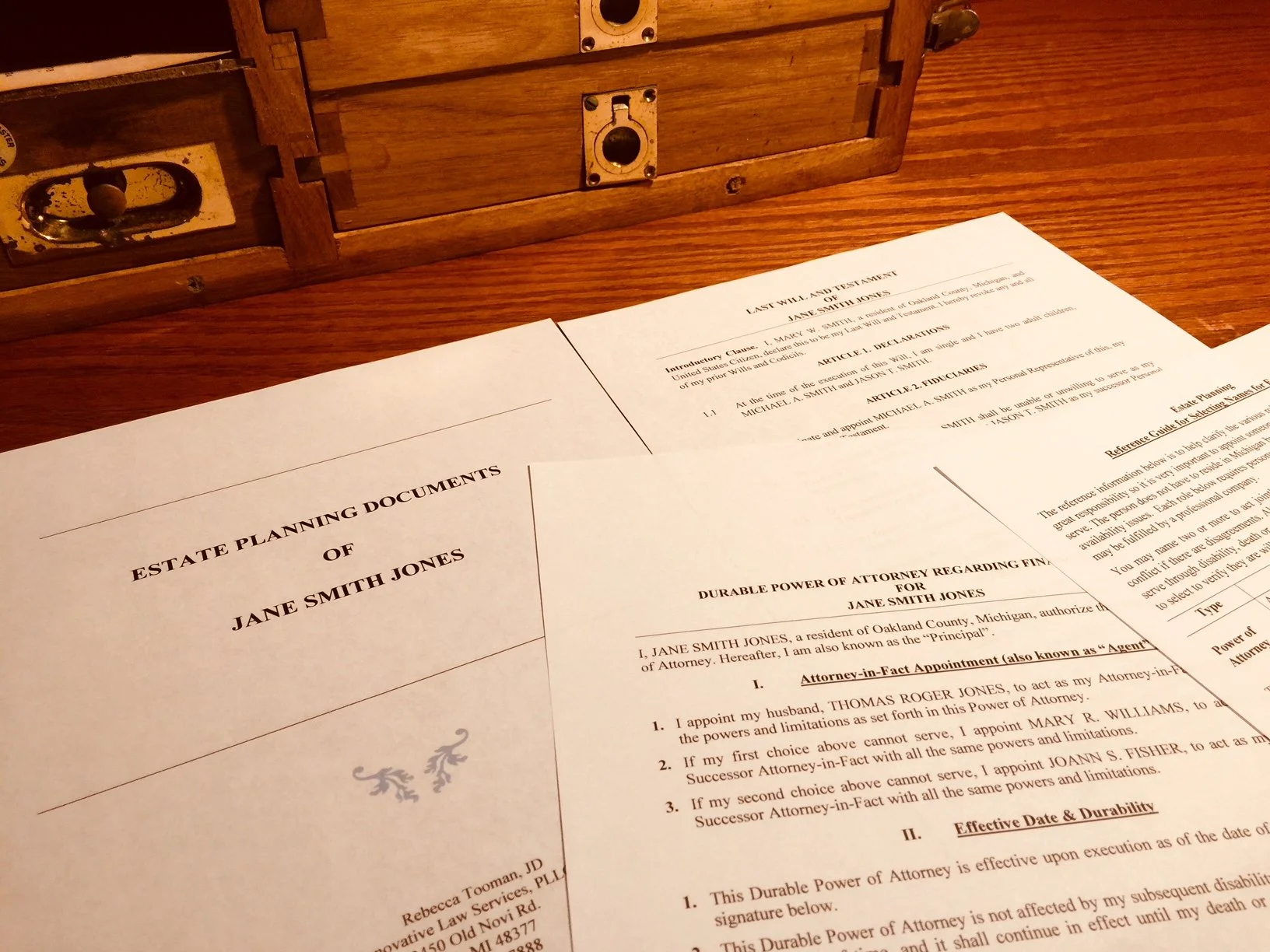

Estate planning is simply scheduling meetings to create legally binding documents that designate trusted individuals to act on your behalf due to disability, incapacity, and death. The various roles include a person to act as your personal representative (also known as executor), guardian and conservator for minor children, and agents with authority to help manage finances and advocate medical decisions. Estate planning provides peace of mind with legal documents in place to help timely and economically resolve legal matters during critical life events. Each person’s situation is unique, and we will help customize the legal documents to fit your specific needs. Please contact us using form below to schedule a meeting to learn more about Wills, Trusts, Powers of Attorney, Patient Advocate Designation, and other estate planning options. The initial consultation is at no charge.

When to update your estate plan:

Becoming a parent or grandparent

Purchased real estate in Michigan

Death of loved ones

Incapacity of your spouse or loved ones

A foreseeable need to move to a nursing home

Your children are now young adults

Regular revisions to accommodate life changes and law updates

Cottage law planning for vacation home

Change of marital status

Family relationship change

Pet trust planning

Checking off your bucket list (i.e. swimming with the sharks or skydiving)

Asset protection (no matter how big or small)

Designating the ages and conditions for family to inherit funds

Business succession planning

Moved to Michigan and need to revise out of state documents

Estate Planning Reference Guide

Estate planning involves educated decisions along with designating friends, family or professional fiduciary advisers to help manage personal matters. The selected individuals should be trustworthy and willing to help advocate for your needs and wishes. Each estate planning document provides a list of powers and limitations based on personal preferences. It is important to discuss these roles with the person you intend to select to verify each person is willing to serve.

You may name two or more individuals to act jointly that would help create a check and balance, however, if there are any disagreements then a trip to court may be required to resolve any disputes. Please review the below information to help select a primary person and at least one alternate person for each role. Naming an alternate person to assist is strongly recommended just in case the primary person is unavailable or unable to assist.

General DURABLE Power of Attorney

A Power of Attorney extends legal authority to another trusted individual appointed to act on your behalf to manage your finances and other daily responsibilities. The power of attorney may include limited duties such as a real estate transaction or an extensive list of broad powers. The power of attorney is also known as an attorney-in-fact or agent. You are known as the principal. A power of attorney is not filed with the court and terminates upon death. You may revoke the power of attorney at any time (while of sound mind). Without a Durable Power of Attorney, a petition would have to be filed with the probate court to request a conservator to manage financial affairs due to incapacity. Please note that MCL 700.5409 lists the persons with priority to act on your behalf as a conservator if you become incapacitated without a written nomination in place. A power of attorney may spring into action at the time of incapacity based on certification by a licensed physician (known as a Springing Power of Attorney) or it may be effective immediately upon execution.

Timing: Life

Why: Manage financials when necessary

Example: Coma, accident, or illness

Patient Advocate Designation

A Patient Advocate Designation allows a person to make medical decisions on your behalf if you become incapacitated due to illness, surgery, injury, or mental disability. It is also known as a Durable Power of Attorney for Health Care. Select at least one Patient Advocate (an adult) that you trust to respect your wishes and is capable of making difficult decisions even if different from the opinion of your family members or medical providers. MCL 700.5313 provides an overview of who the court may appoint as guardian of a legally incapacitated individual, if necessary.

Timing: Life

Why: Decisions for medical care

Example: Illness, stroke, or life support

Personal Representative

A personal representative is designated within a Last Will & Testament to help settle an estate that requires probate court. This role was previously known as an executor. The court may appoint a legal representative when necessary. The duties include collecting assets, preparing an inventory, paying debts, expenses, claims, selling assets, distributing property and funds to beneficiaries. A complex estate that involves business interests should consider using a professional fiduciary. Probate court is required for approval of a nominated guardian & conservator for an incapacitated adult and with cases involving minor children.

Timing: Death

Why: Probate Court required to resolve estate

Revocable Trust

A revocable trust is a legal agreement to privately manage assets, plan for disability, and upon death allow assets to be transferred based on specific instructions to beneficiaries. The person or couple that creates the trust agreement is known as a settlor, initial trustee, and grantor. A Trust is very beneficial for both simple and complex estate planning goals. A Trust is privately managed compared to a Will that must be submitted to probate court for judicial approval to resolve an estate. A Trust may offer asset protection from potential creditors with a spendthrift provision. After the initial trustee’s incapacity or death, a successor trustee would take over to manage the trust assets. It may be helpful to select the same person as Power of Attorney and Successor Trustee. It is important to remember that a successor trustee may continue for many years based on the timing of distributions to each beneficiary.

For estate planning with a minor child: Trust provisions include distributions for health, education, and support until a child is of sufficient age to receive direct distributions. Without a Trust, a minor child would typically receive inheritance funds at the age of eighteen.

Business owners or self-employed trustees should consider naming a Trustee that is knowledgeable about the business.

Timing: Life if disabled or incapacitated and provides specific instructions upon death without the need for probate court

Why: To privately manage trust assets based on specific directions over a period of time

Estate Planning Terms:

Durable General Power of Attorney. Power of attorney documents authorize a trusted person to act on your behalf to help manage your finances and other daily responsibilities. A person designated as your agent for the power of attorney role is also known as your attorney-in-fact. A power of attorney may include limited duties such as selling property or an extensive broad list of powers to manage all areas when you need it most such as illness, travel or incapacity. It may be effective upon execution (once signed) or a springing power of attorney (after determined to be incapacitated by one or more physicians). The power of attorney documents must be signed while of sound mind. A durable power of attorney may eliminate the need for a court-appointed conservator to manage financial affairs due to incapacity. A power of attorney is not filed with the court and terminates upon death.

Patient Advocate Designation. A Patient Advocate Designation provides authority for a trusted friend or family member to make medical decisions on behalf of another person due to incapacity, injury, or mental disability. It is also known as a Durable Power of Attorney for Health Care or an Advanced Directive. It is helpful to select a person that will respect your wishes and make difficult decisions even if different from personal opinions or the opinion of family members.

Personal Representative. A personal representative is typically named in a will to help settle an estate that requires probate court. This role was previously known as an executor. The extensive duties include collecting and securing assets, managing property, preparing an inventory, paying debts, determining creditors, attending court hearings, filing taxes, settling claims, selling assets, distributing property and funds to beneficiaries.

Will & Last Testament. A will is a document that must be submitted to the probate court by law, see MCL 700.2516. The Will provides a set of instructions that must be approved by the probate court. In comparison, a Trust Agreement is a private document that is not filed with the probate court unless an interested person files a case (i.e. disputing terms of the trust).

Trust & Trustee. A trust is a legal agreement to privately transfer assets to beneficiaries and avoids or minimize the probate court process. A trust agreement may be beneficial when you have minor children, prefer a long term arrangement with asset protection from creditors, or prefer to customize how funds are distributed to various beneficiaries. The person that creates the trust is known as the settlor, initial trustee, and grantor. After the initial trustee's disability or death, a successor trustee takes over to manage the trust agreement provisions. It may be helpful to select the same person as power of attorney and successor trustee to transfer the role during lifetime to after death.

Requirements and Recommendations for Choosing a Patient Advocate:

A family member or friend (must be over 18 years old)

Understands your preferences and is willing to make difficult decisions

Able to question medical decisions with doctors, nurses, and social workers

Advocates for best treatment options, medications, and tests

Other helpful estate planning documents:

Funeral Representative Designation

Durable Power of Attorney Delegating Parental Authority

Business Succession Planning

Cottage Law & Cabin Operating Agreements

Managing Health Care Choices

Health Insurance Portability and Accountability Act Authorization (HIPAA)

Ladybird Deeds or Life Estate Deeds - a great tool for transferring real estate after death while maintaining control of the property during life

Property Transfer Affidavits

Trust Agreements

Certificate of Trust

Distribution of Tangible Personal Property

Pour-over Wills

Power of Appointment

Revocation Forms

Authorization for Anatomical Gift

Acceptance of Agent Designation

Transfer on Death Designation

Final Wishes

Please use the form below to schedule a consultation.